LATEST

NEWS

A well-informed membership makes the co-op housing movement stronger. Keep up-to-date on the latest CHF BC, and co-op housing related, goings-on by reading our latest news below. To get this news—and more— delivered directly to your inbox, subscribe to our newsletters.

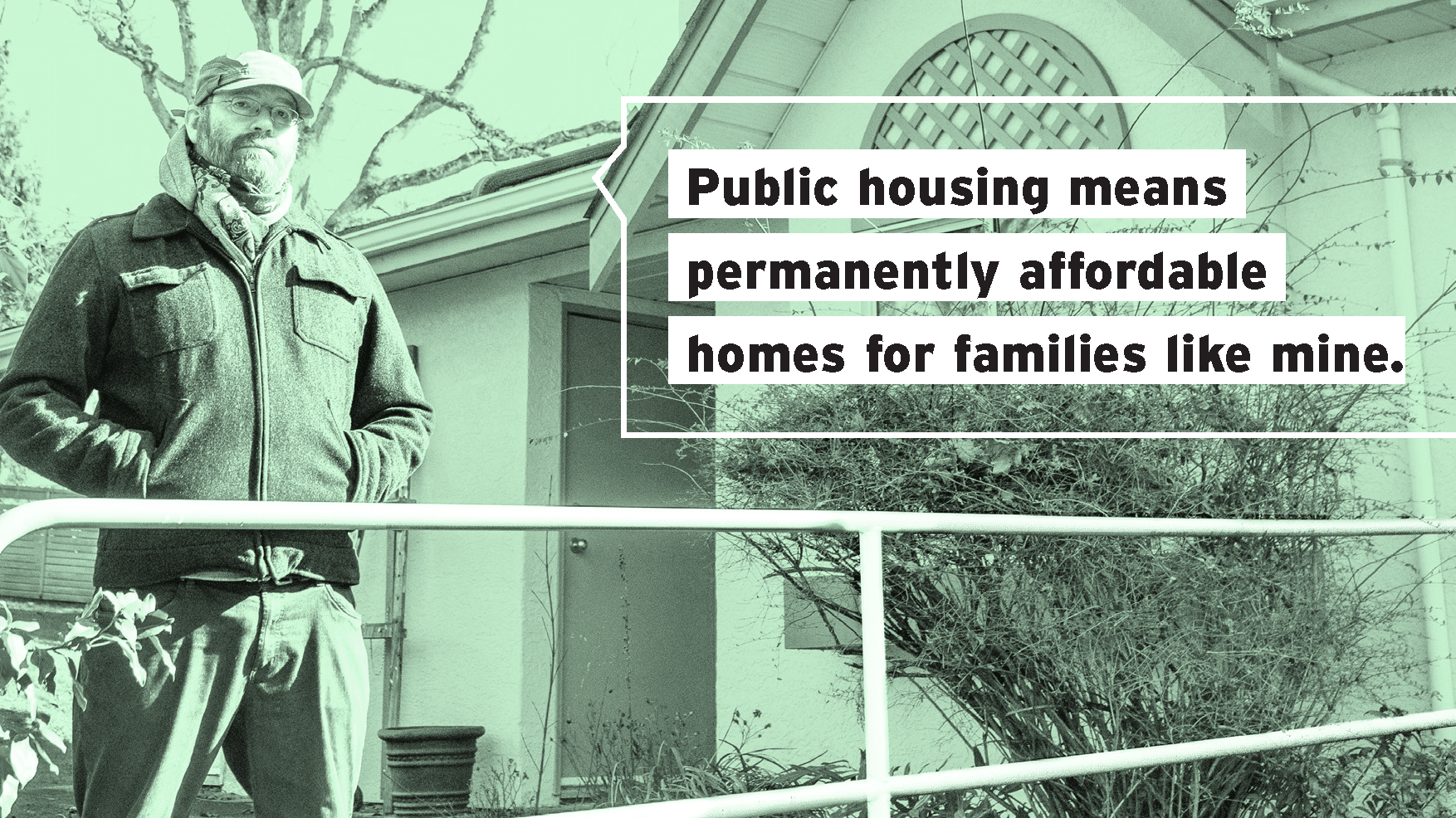

Video: How Public Housing Unlocks Permanently Affordable Homes

This insightful exploration of the housing crisis looks at why publicly owned non-market housing—aka community housing—is the best way to provide affordable homes for people in British Columbia.

Please take a few minutes to watch the video for a deeper understanding of this important topic.

Province maintains historic commitment to affordable homes for British Columbians

BC Budget 2024 includes modest spending increases in previously announced provincial housing measures.

British Columbia continues to lead the country in housing investments to benefit low- and moderate-income households. CHF BC, CLT, and the rest of B.C.’s community housing sector is pleased to see these investments maintained and, in some cases, increased.

$2 Billion Federal Investment Empowers Innovative BC Builds Program

On February 20, 2024, Canadian Prime Minister Justin Trudeau announced the federal government will be adding another $2 billion in financing to BC Builds

The announcement also included BC Builds’ fourth site with 112 new co-operative homes for middle-income households in Vancouver.

Video: B.C. Premier on the importance of co-operative housing

During his announcement of the acquisition of 2 Coquitlam housing co-operatives, B.C. Premier Eby discussed the important role that co-operative housing plays in meeting the challenges of the housing crisis.

During his remarks, he noted that co-ops are a model of housing that works. It’s stable housing, it’s affordable housing, and it’s also built-in community.

Good News! Media Coverage of the Coquitlam Co-op Acquisition

On February 8, 2024, B.C. Premier David Eby announced the historic acquisition of two Coquitlam housing co-operatives by the Community Land Trust. It was the first investment of the recently created Rental Protection Fund (RPF).

Check out the video of the announcement, as well as links to some media coverage.

A Significant Victory for Co‑operative Housing in Coquitlam

Coquitlam is celebrating the acquisition and preservation of 290 co-op homes by the Community Land Trust. This was made possible through a contribution from the Rental Protection Fund (RPF).

This is a significant milestone for co-operative housing in B.C., It marks a crucial step forward in protecting housing security for co-op members in B.C.’s daunting housing landscape.

New federal co-op investments welcome, but timeline is disappointing

In a CBC News story by Jon Hernandez, Thom Armstrong, the CEO of CHF BC called the measures "well-intended," but he raised alarm over the lack of a timeline, with dollars only starting to roll out in 2025.

He notes that "We’re in a housing crisis and is baffled as to why an economic recovery would have to wait until 2025-2026 to address what’s a burning crisis right now."

VIDEO: BC Community Housing Fund (CHF) 2023 Webinar

This video offers a detailed overview of the Community Housing Fund and a step-by-step guide on eligibility, program requirements and how to apply.

Civic Innovators: Renovate the Public Hearing

Do you ever wonder why some neighbourhoods are all single-family homes while others are high-rises, shops, and duplexes? Did you know you get to be part of that conversation?

Since April CityHive’s Civic Innovators, a group of youth (ages 18-30) from across the province of B.C., have been hard at work coming up with entirely new systems of governance and making recommendations on how to improve the public hearing process.

BC opens $500M Rental Protection Fund

A $500-million rental-protection fund that will help non-profit groups purchase rental buildings has opened in British Columbia.

The fund aims to help First Nations and other non-profit groups buy older “affordable” rental buildings to preserve them as low-cost rental housing.

CMHC Support for Deep Energy Retrofits

CMHC recently announced the Canada Greener Affordable Housing program (CGAH). The program focuses on supporting deep energy retrofits for existing multi-unit residential buildings. The goal is to see buildings achieve near net zero emissions.

As with all CMHC programs, there are multiple eligibility criteria, but the most critical are the very ambitious targets for energy consumption reductions and emissions.

Housing Central’s B.C. Budget 2024 Submission

On June 16, 2023, BC Non-Profit Housing Association, the Co-operative Housing Federation of BC, and the Aboriginal Housing Management Association submitted our Budget 2024 consultation paper.

Taken together, our proposals will ensure that British Columbians have increased access to affordable housing and that their housing is affordable, safe, and in a livable state of repair.