Important: Changes to the Multiple Home Owner Grant Application for 2017

When it comes your co-op’s property taxes, although the co-op itself is the home owner, each unit has a member (called the “eligible occupant”) who needs to provide a signature to complete the home owner grant application. Then the co-op (or its management company) can submit the claim and take advantage of the home owner grant. The basic grant is refunded directly to the co-op for the benefit of the membership as a whole. Some members, like seniors and people with disabilities, will be eligible for the additional grant which is refunded directly to them.

In 2017, the process for submitting home owner grant applications for multiple home owners has changed. If your co-op employs a management company, your staff are likely aware of the changes. But if your co-op is self-managed, or you just want to understand more, please read on.

For anyone responsible for applying for the home owner grant and paying rural or municipal property taxes on behalf of the eligible occupants living in your building or on your property, there are changes to how you apply for your multiple home owner grant. You, the person responsible for filing, will now use a secure online service called eTaxBC to manage your list of eligible occupants and apply for the multiple home owner grant (formerly called your Form A). eTaxBC is available twenty-four hours a day, seven days a week.

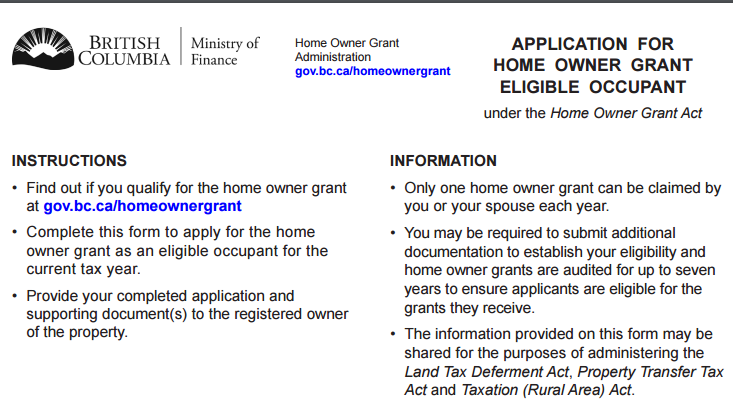

In the past, you were able to collect all of your eligible occupants’ information on a single paper form. Now all eligible occupants must complete their own Application for Home Owner Grant Eligible Occupant (FIN 68) form. On behalf of the co-op (the property owner), you will collect all of the completed forms from your eligible occupants. Then you will use eTaxBC to compile your eligible occupant information, apply for the home owner grant and calculate your property tax amount. The process will vary slightly depending on if you are applying for a property in a municipal or a rural area. You can find more information on the Multiple Home Owner Grant webpage.

It is also important to know that if any member forms have errors that need “alterations” they might not be accepted. If you need to cross-out or white-out information, it is not enough to initial the change. In those cases, it is better to have the member complete a new form with the correct information. However, if a form is just missing information and the changes you need to make are to check a box or fill in something that was blank, there’s no need to start with a new form – just ask the member to complete what was missed.

If you have questions, please feel free to get in touch with us at members@chf.bc.ca.